What happened to the little guys?

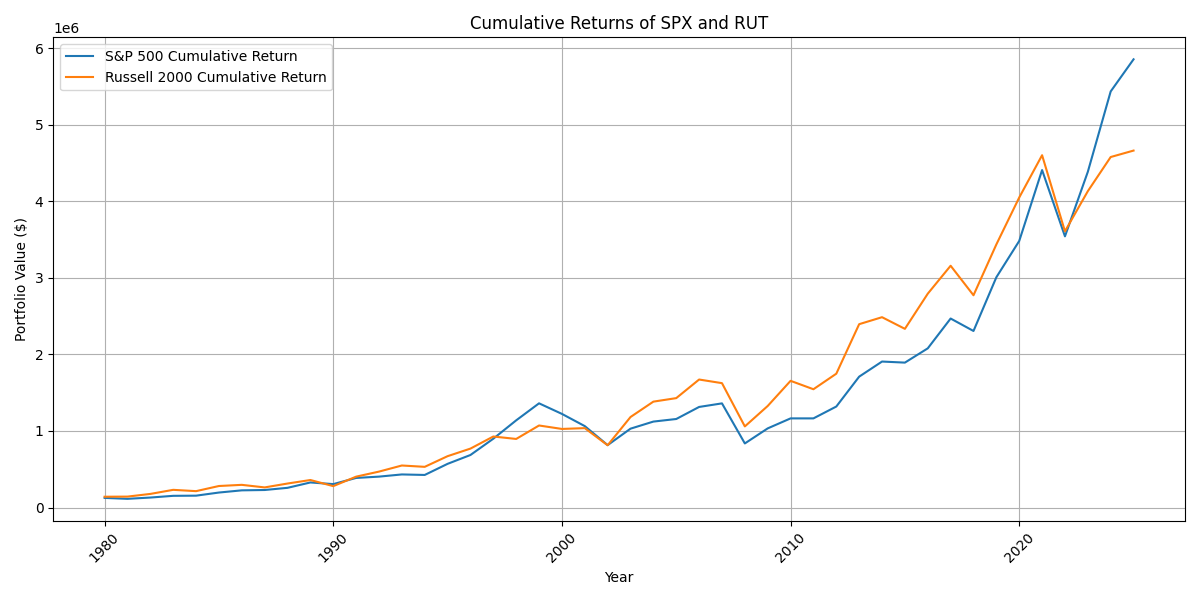

It’s no secret that the large-cap end of town has been outshining their smaller counterparts for some time now. While the S&P 500 has been pushing all-time highs for consecutive weeks, the Russell 2000 has been trudging slowly upward, struggling to reach its heights that barely surpassed those of 2022.

Historically, smaller cap stocks have been said to offer higher returns, albeit with a higher expected risk. In the last ten years, however, the Russell 2000 has outperformed the S&P 500 on an annual basis only twice. Compare this to the ten years prior, and it was five out of ten times, and the decade prior to that, seven out of ten times. So, what happened?

Given how broad the Russell 2000 is, quite a few things need to happen to have index fortunes change so dramatically.

Firstly, there is the effect of interest rates and inflation. Smaller companies are less likely to be profitable than their larger counterparts and will therefore rely far more on loans; loans that have become far more expensive in recent years.

Secondly, there is the role of AI. AI has been a massive market force in the past five years, and most of the AI technology comes from large-cap tech stocks. According to the Wall Street Journal, tech stocks make up 34% of the S&P 500 by value, compared to only 13% of the Russell 2000. Lacking the same level of exposure to the AI boom, the small-cap indexes are being left behind.

Lastly, there is the role of passive investment, which has disproportionately grown larger cap stocks. As both retail and private investors shift their investment towards passive investment methods such as index funds and index ETFs weighted by market cap, the largest companies within these naturally benefit the most.

In short, the little guys are facing a perfect storm. Higher interest rates, a tech-driven rally that favours the giants, and the rising dominance of passive investing have all conspired to leave small caps behind. While history shows they can deliver outsized returns over time, the current market dynamics are tilted against them. That doesn’t mean they’re down for good. Cycles shift, and opportunities emerge when expectations are lowest. But for now, small caps will have to wait their turn in a world driven by mega-cap momentum and AI tailwinds.

Take a 14 day free trial to see how we can help you capture profit from these various market cycles.