Have The Magnificent 7 Lost Their Shine?

For the past decade, the US stock market has been dominated by a cadre of mega-cap tech stocks. Buoyed by consistently solid returns, these stocks have become the focus of many investors, and their performance, earnings, and outlook have in some ways become a barometer for the entire US market. In 2024, these stocks accounted for half of the S&P 500’s 23% return. These are the ‘Magnificent 7’ comprising Amazon, Apple, Alphabet (Google), META, Microsoft, NVIDIA, and Tesla. However, despite their massive influence, these stocks appear to have lost traction, lagging the broader market in 2025. So, have the Magnificent 7 lost their shine?

How have the Mag 7 performed so far in 2025?

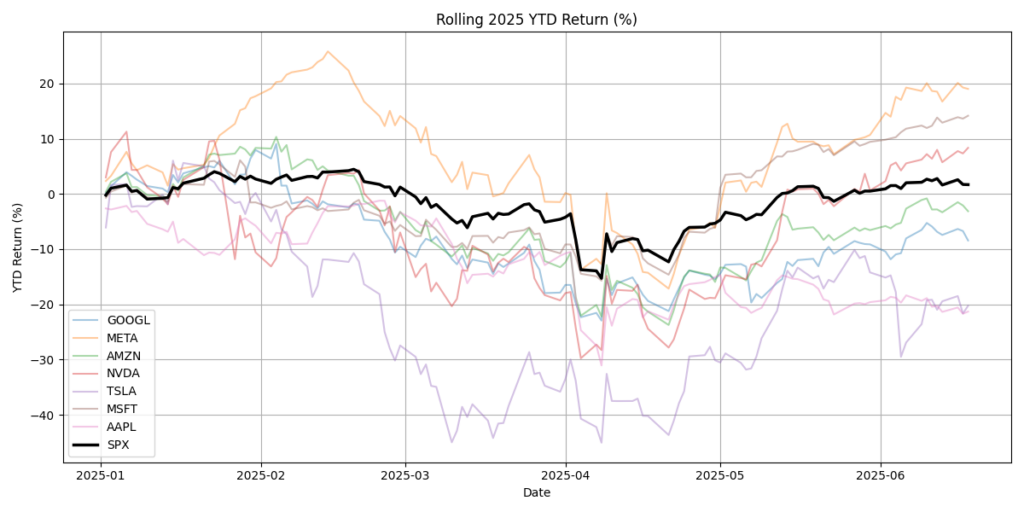

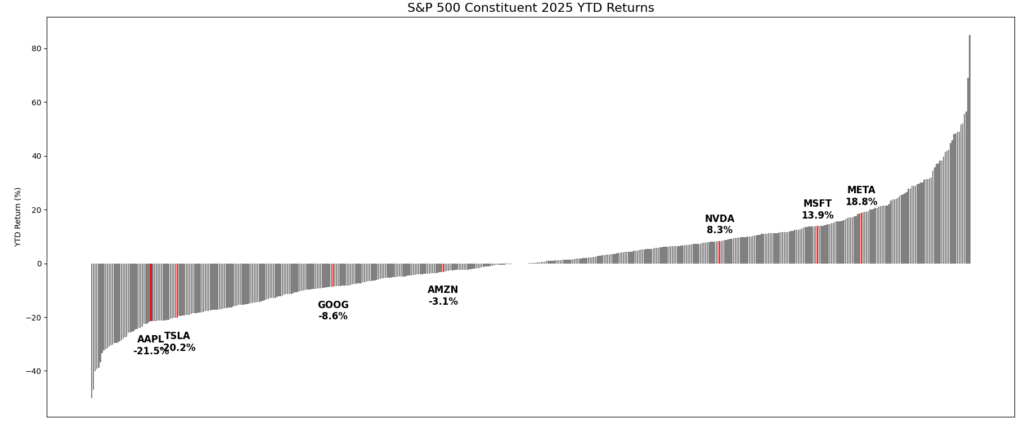

As of writing, 4 of the 7 are showing negative returns for YTD 2025, coming in below the overall S&P 500 return. The Bloomberg Mag7 total return index currently puts the collective YTD return at -2.11%, compared to the S&P 500’s +1.7%. The best performer is Meta, currently sitting at an 18.83% YTD return.

However, if we rank all the individual returns of the S&P 500, Meta sits at number 63 overall. Meanwhile, the worst-performing of the 7, Apple, sits all the way down at number 469.

Why the slowdown?

There are several reasons these stocks might be experiencing lower returns.

Firstly, increased market risk across 2025 has likely led investors to diversify their portfolios away from the Magnificent 7. The overweighting of these stocks was a persistent worry across 2023 and 2024, and investors taking a cautious approach appear to be less interested in these stocks. NVIDIA, for example, has seen its average volume almost halve from the same time one year ago. According to Reuters, hedge funds in particular were cutting their exposure in April due to earnings worries.

Secondly, is the direct impact US protectionism has had on these companies and their supply chains. Apple, for example, was threatened with 25% tariffs on all iPhone sales if they continued to manufacture them abroad. Conversely, analysts have also been concerned about export restrictions on NVIDIA, which threaten to block off large parts of the global market to the company.

Do the Magnificent 7 still hold?

While their performance for the year has been mostly lacklustre, the seven still dominate the market landscape and remain bellwethers of the broader market’s fortunes. During the May earnings season, most of the Magnificent 7 experienced rising revenue, although they also provided cautious outlooks. The current political pressures may have put a hold on their runaway growth, but it is not yet time to write them off completely.

With global markets struggling to find their footing amidst chaotic times, diversification is proving, as always, to be a prescient strategy. Take our 14 day free trial to view our various low correlated strategies.