Growth Portfolio

An Active Investment Strategy

The Growth Portfolio is a trend following strategy. The strategy is designed to keep you invested when the market is rising, yet will inform you to exit positions to protect your capital when the market declines – as it did during the GFC.

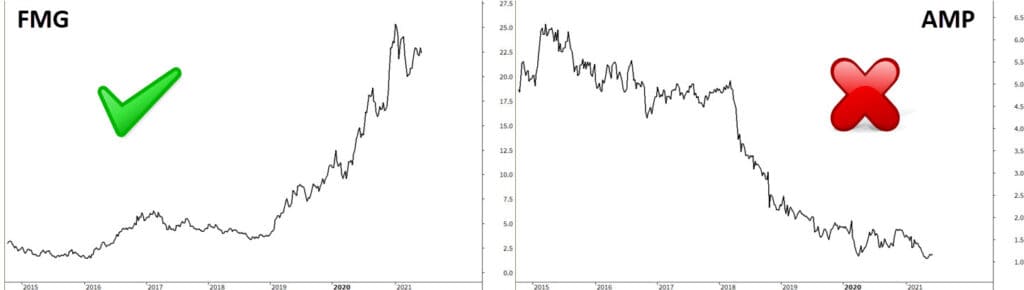

Below are examples of trades the Growth Portfolio WILL and WILL NOT take.

It is an active, intermediate-length strategy with trades held for around 6-8 months.

Whilst we do not disclose the exact rules of the Growth Portfolio, the strategy is loosely based on the Bollinger Band Breakout strategy discussed on page 118 of Unholy Grails. Unholy Grails discusses this style of active investing and is recommended reading for all users.

Recommended Requirements

You will need an online or discount broker. Trish and Nick Radge use SelfWealth to trade the Growth Portfolio.

We suggest a minimum account size of A$30,000.

How it works

The strategy is designed to be as user friendly as possible. To build a portfolio simply divide your capital into 10 equal portions, representing 10% allocation to each signal.

When a signal is recommended, place the order for the opening auction the following day.

Once a portfolio of 10 positions have been established, you may ignore any additional entries and await an exit signal.

Stop-loss orders are not used. Whilst we do use stop losses and protective measures, these are not placed in the market.

Exits are based on the day’s closing price and then executed on the next session’s open.

Expected Performance

A lengthy discussion on the strategy history can be found HERE

**Please read the Performance Disclaimer below

Growth Portfolio FAQs

How much does the Growth Portfolio cost?

Membership to the Growth Portfolio is currently closed. If you would like to be advised when membership reopens, register here.

What payment methods do you accept?

Payment is via credit card however we can also provide an invoice if you would like to pay via bank deposit. To request an invoice, email Trish and include the name of the individual or entity for the invoice, address and phone number.

Is the membership tax-deductible?

Check with your accountant or tax advisor.

When joining the Growth Portfolio, how do I get started?

When you start following the strategy, gradually build a portfolio of 20 stocks based on new signals, as they are generated.

Which broker do you use?

We use SelfWealth for this portfolio but you can use the discount or online broker of your choice.

Do I need any software?

No. The Growth Portfolio is an advisory service and does not require you to buy software or data.

A more extensive list of FAQs and instructions is included within the Members Area.