The Weekend Trend Trader in Canada

Testing and trading different markets offer two distinct benefits:

1. strategy diversification2. robustness and stress checking

In order to test new markets we require a complete data set, namely all delisted stocks, and if trading a specific universe, historical constituents.

This specialist data is very hard to come by. Our long time friends over at Norgate Data have been at the forefront of this data for Australia and the US.

They’re now in the process of releasing Canadian data and I’ve been happily beta-testing before a public release some time in 2022.

This new Canadian data allows us to test our existing strategies on completely unseen data and provides some new insights on their robustness.

For this exercise we’ll take the Weekend Trend Trader strategy with the exact some parameter settings as outlined in the original 2012 e-book. We’ll use the full market as our universe, including all delisted stocks. Commission will be default Interactive Brokers commission of $0.01 per share or minimum $1.00.

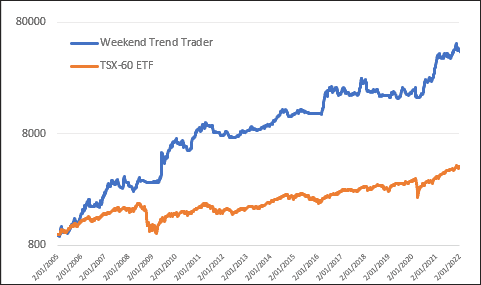

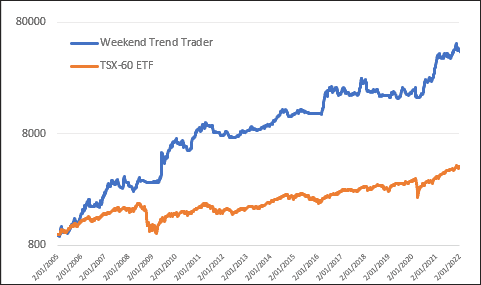

Here’s the equity growth from 2005 through today.

The Canadian market is very similar to the Australian market. Namely a majority of commodity based stocks with a handful of large banks thrown in the mix.

While volatile, the Weekend Trend Trader produced a return of 24.9% with a maxDD of -33.6%. This bodes well against the Buy & Hold of 8.7% CAGR and maxDD of -47.1%.

Whether or not to trade the strategy on the Canadian market is yet to be decided. Yet the key takeaway, at least for me. Is the robustness of the Weekend Trend Trader strategy.

Note: Thanks to John Copp CMT for useful background info about Canada.