Should I Adjust My Trading Strategy?

People often wonder should I change my trading strategy? It’s been a tough month or two in the markets with some historic moves across stocks, commodities, currencies and bonds. (View my quick market update 24th March)

Not many strategies have escaped the carnage. Even some of the ‘best of the best’ hedge funds have come somewhat unstuck.

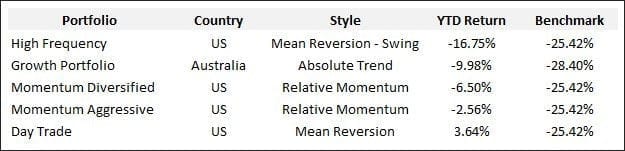

Here’s how my performance is looking so far in 2020:

How we deal with what’s just taken place?

Do we surrender and concede it’s all too hard?

Do we pivot and completely change the way we invest?

Do we tweak our strategies?

Or do we stay the course and keep pushing forward?

Over the last week I’ve had 5 emails from clients trading our strategies or trading our Turnkey Strategies, providing suggestions on how those strategies could be improved.

But here’s the thing; it’s important not to make hard and fast decisions based on a single event. Especially as that event is unfolding.

That’s emotion. That’s ‘pain avoidance’ talk. That’s also human nature. “I didn’t like that, so I need to do to ensure it doesn’t happen again.”

Every adjustment to a strategy will have an opposite effect somewhere else in the equation. As a rule of thumb, attempting to remove pain, i.e. getting out earlier, reducing drawdown etc, will usually dilute the long term return.

Here’s an example. The two momentum strategies above are both monthly. In other words decisions and trades are only made at the end of the month. No action takes place during the month. When the markets are tanking, like now, you may be inclined to panic.

So one suggestion this week was, “Why wait till month end? Let’s do it weekly.”

Sound logic or pain avoidance? Let’s test it.

We take the Momentum Aggressive strategy, which is from our sister site Trade Long Term, and test rotating monthly, weekly and daily.

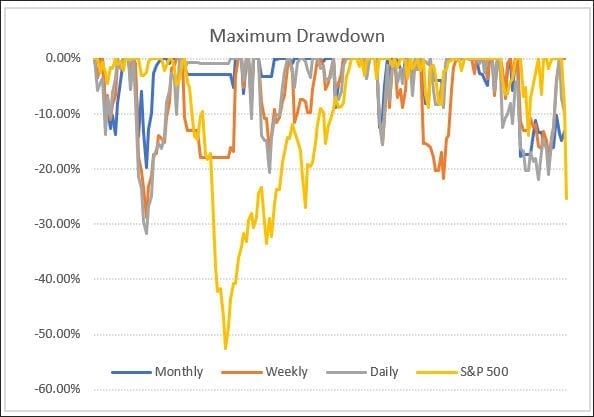

Here’s the drawdowns for each strategy…

It’s a little difficult to decipher from this chart, but on a monthly close basis, the monthly strategy is currently at -13.1% drawdown, the weekly at 0% and the daily at -9.8%.

So taking a weekly signal did appear to be the right thing to do in this case.

But how does that measure out over the longer term?

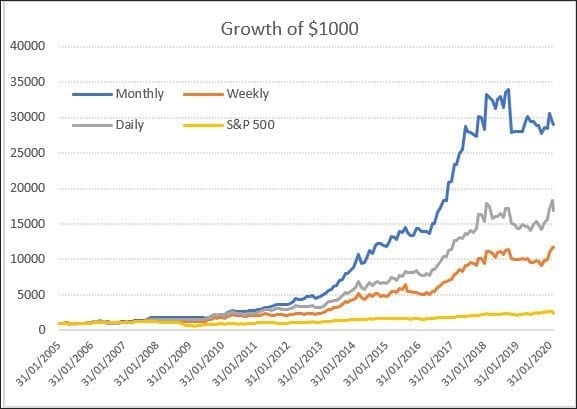

Here’s the equity growth of each from 2005.

It’s clear that the monthly variant is struggling a little over the recent period, but it’s well ahead of the other two. Indeed, the weekly version is the worst performer. The CAGR for the monthly is +24.7%, the weekly +17.6% and the daily is +20.1%.

The net profit of the monthly is 2.5x that of the weekly.

Taking a look at the maximum historical drawdown (maxDD), the numbers also point to the monthly actually being better. The monthly has a maxDD of -19.67%, the weekly stands at -28.8% and the daily blows out to -31.7%.

In summary and with the benefit of hindsight, yes, the weekly would’ve been better this time around. However, prior to this event we didn’t have the evidence to support that decision.

In closing I’d like to make mention of one thing.

You can’t have return without risk. If you want to play this game you need to suck it up. If it were easy everyone would be doing it.

I firmly believe that the difference between long term successful traders and everyone else, is the ability to stay the course and roll with the punches.

If you would like some further reading.