Multi-Strategy Testing

Last week we announced our move across to new strategy development software RealTest. This is a big deal for us, manly because it’s been 17-years since we had a move to a new platform, and secondly, and most importantly, we’re excited about the prospects that RealTest offers our own trading, and that of our clients.

You can do a free 30-day trial of the software HERE.

Since announcing our move we’ve had a barrage of questions, some of which you may benefit from, so here they are…

I have used Amibroker for several years. Do I need to move to RealTest?

No. The two key reasons we’re moving is for multi-strategy portfolio testing capabilities, which Amibroker cannot do, and an easier coding language. If you are thinking of testing multi-strategy portfolios, then I’d seriously consider RealTest

What do you mean by multi-strategy testing?

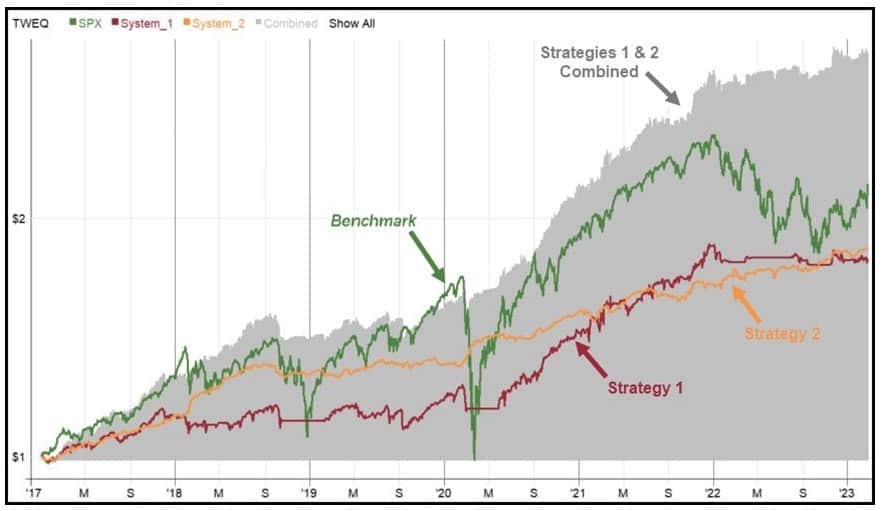

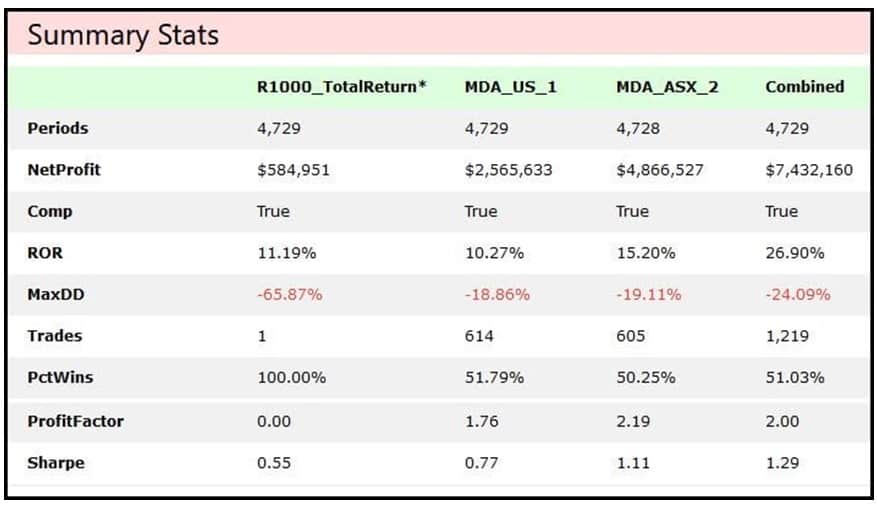

In its simplest form, RealTest allows us to backtest two or more strategies together using the same capital, then allows us to compare the combined result. The following chart shows the equity growth for two separate strategies, then the equity growth when both combined using 50/50 allocation to each.

Why test two strategies together?

There are various reasons.

Firstly, not all strategies work all the time in all market conditions. By diversifying across various strategies (add markets and timeframes) it’s possible to dilute the negative impacts of a strategy being out of sync with the market. Many retail traders chase performance, in other words, they want to be in the best performing strategy all the time. That’s an impossible task. Using several strategies could ensure that one out-of-sync strategy is helped along by another that is in sync.

Secondly, and somewhat related to the above, is that trading various strategies can smooth the equity growth. In other words, several strategies combined could lower the total drawdown of the portfolio, and in some cases, enhance the returns at the same time.

That has to be a win/win scenario for almost any investor.

Let’s take a look at an example.

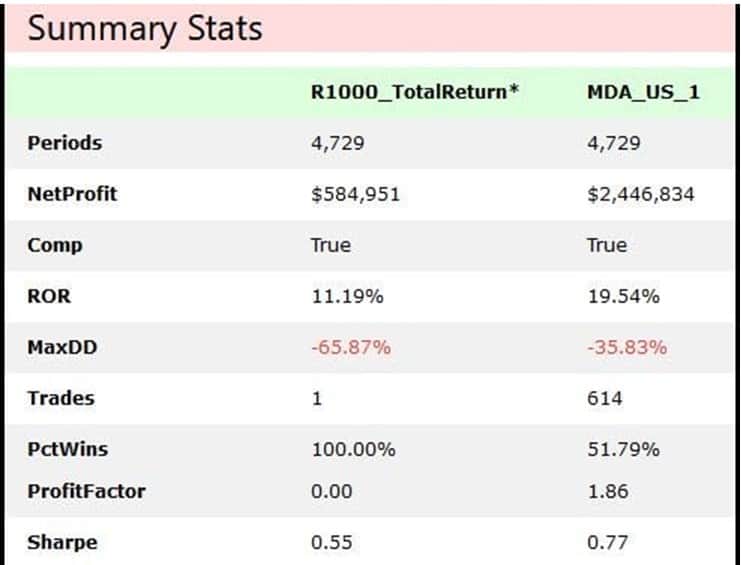

Below is the US Momentum strategy we use to manage investor capital in our Managed Account Service. On the surface it’s not too bad – favourable return and drawdown compared to its benchmark.

Even so, a strategy with that drawdown is still uncomfortable for most retail investors. Many would stop trading this strategy, or, if in their control, would attempt to ‘tweak’ or curve-fit the strategy to remove the drawdown.

The problem is that the more a strategy is massaged, the more likely it loses its robustness and its effectiveness.

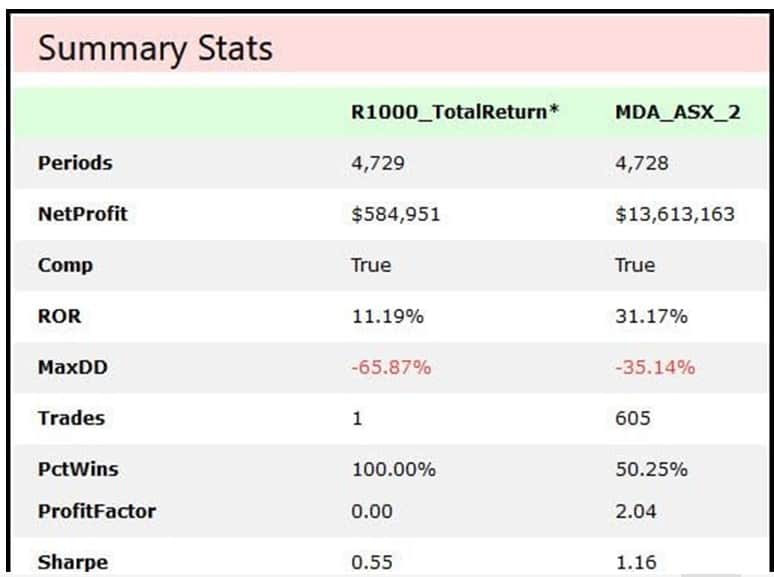

So let’s take a look at a secondary strategy, again on its own. This is another Momentum strategy, but traded on the Australian market.

Well, a better return, but still suffers from an uncomfortable drawdown.

But here’s the magic.

Let’s combine both the US and ASX strategies and allocate 50/50 capital to each.

All of sudden our combined portfolio return is still solid at +26.9%, yet the drawdown has fallen to a much more acceptable -24.09%.

Indeed, I would suggest getting a risk/adjusted return, where the CAGR is greater than the maximum drawdown, is extremely difficult with a single trend following strategy. Not so when they’re combined.

I have bought your Turnkey strategies for Amibroker. Do I need to buy RealTest?

No. We’ll continue to support the existing strategies for Amibroker.

Will you be releasing the Turnkey strategies in RealTest?

Yes. They have been written and we intend to release them in the coming weeks.

I have bought the Turnkey code for Amibroker and wish to move across to RealTest. Do I have to pay for the code again?

There will be a nominal charge of $55 (incl. GST) for the RealTest version.

What data does it take?

You can plug Norgate data. You can also use a csv file, Yahoo or Tingo for free.

A quick note for Chartist members. I’ll be adding a special report to the site shortly which will cross reference various strategies in our service so you can see the benefits of combining the strategies we offer.